MATCHING PRINCIPLE. HOW TO

You have already learned how to complete seven of the steps. The complete accounting cycle involves these nine steps, done in this order: Once this period of time is over, these same steps are repeated in the next period of time of equal length.

MATCHING PRINCIPLE. SERIES

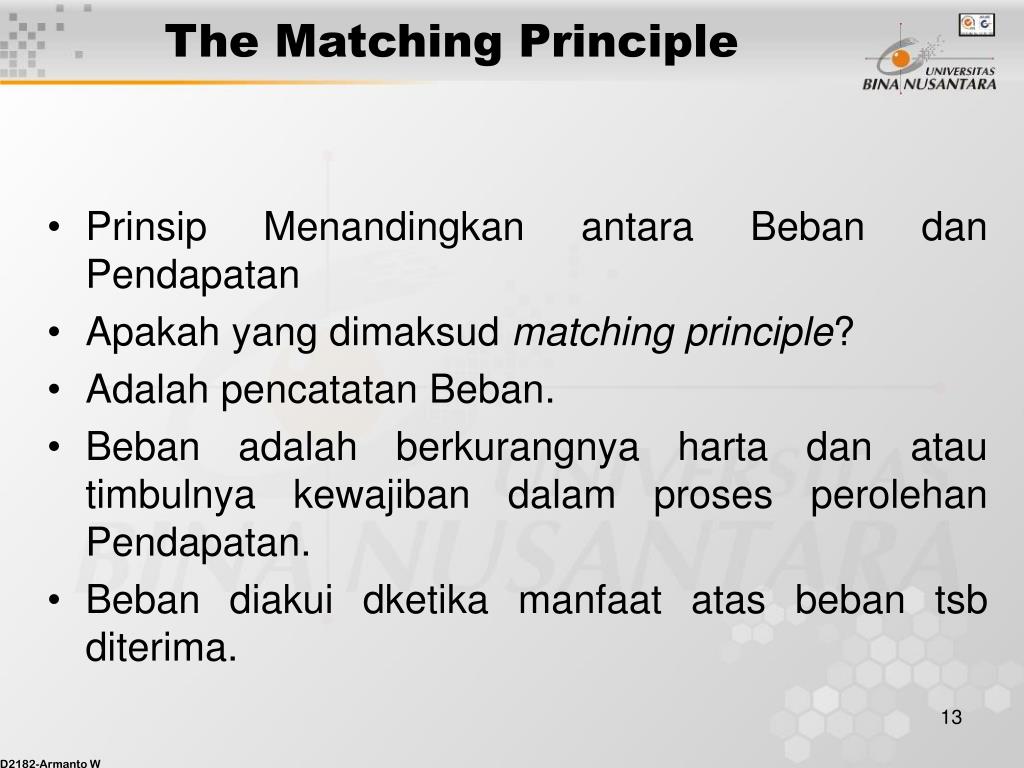

It involves a series of steps that take place in a particular order during a period of time. IMPORTANT: Each adjusting entry will always affect at least one income statement account (revenue or expense) and one balance sheet account (asset or liability).Īccounting is a cyclical process. Adjusting entries are typically necessary for transactions that extend over more than one accounting period-you want to include the part of the transaction that belongs in the one accounting period you are preparing financial statements for and exclude that part that belongs in a previous or future accounting period. This is what you will do by making adjustingentries, and this will ensure that your financial statement numbers are current and correct. Many ledger account balances are already correct at the end of the accounting period however, some account balances may have changed during the period and but have not yet been updated. Now we will see situations where they are necessary and will be using the accrual basis of accounting. So far we have dealt with companies that did not need adjusting entries under the cash basis of accounting. They bring the balances of certain accounts up to date if they are not already current to properly match revenues and expenses. The net income for June, therefore, was $80 ($200 - $120).Īdjusting entries, discussed next, help do the job of matching the June revenue with the June expenses by “chopping” off amounts of transactions that do not belong in a given month.Īdjusting entries are special entries made just before financial statements are prepared-at the end of the month and/or year. In June, $200 of revenue ($50 + $100 + $50) was earned and is matched with $120 ($30 + $60 +$30) of expenses that were incurred in the same month. The result appears in the Timeline #2 below. We have to “chop off” the pieces of these transactions that did not occur in June to be left with only the parts that belong in June. We want to include all the revenue and expenses that occurred in June, but none that occurred in May or July. Let’s say we want to produce an income statement for June, our window of time. As you can see, only half of the expenses from Jobs 1 and 3 was incurred in June. There was a total of $180 of expenses, but not all of it was incurred in June. Expense 6 also began in June some of it was incurred in June and some in July. Expense 5 began in June and all of this expense was incurred in June. Expense 4 began in May and was incurred partially in May and partially in June. As you can see, only half of the revenue from Jobs 1 and 3 was earned in June. There was a total of $300 in revenue from these three jobs, but not all of it is earned in June. Job 3 was started in June and was completed in July. Job 2 was started in June and completed in June. Job 1 was started in May and completed in June. The red bars represent revenue-three different jobs for $100 each. Any revenue or expenses before that month or after that month are not considered.īelow is Timeline #1, which includes three months. It compares how much came in in sales in a month vs. The key here is the “window of time,” such as a month. The matching principle looks at a window of time in terms of how much income came in and how much it cost to generate that income. You have probably heard that “It takes money to make money.” A business person contributes financial resources and hopefully uses them effectively to generate even more value. He has written for HedgeWorld and The Federal Lawyer and is the author of books including "The Decline and Fall of the Supreme Court." Faille received his Juris Doctor from Western New England College.\) Albright 2007Ĭhristopher Faille is a finance journalist who has been writing since 1986.

Accounting Coach: Accounting Principles.Accounting Coach: Accrual Basis of Accounting.

0 kommentar(er)

0 kommentar(er)